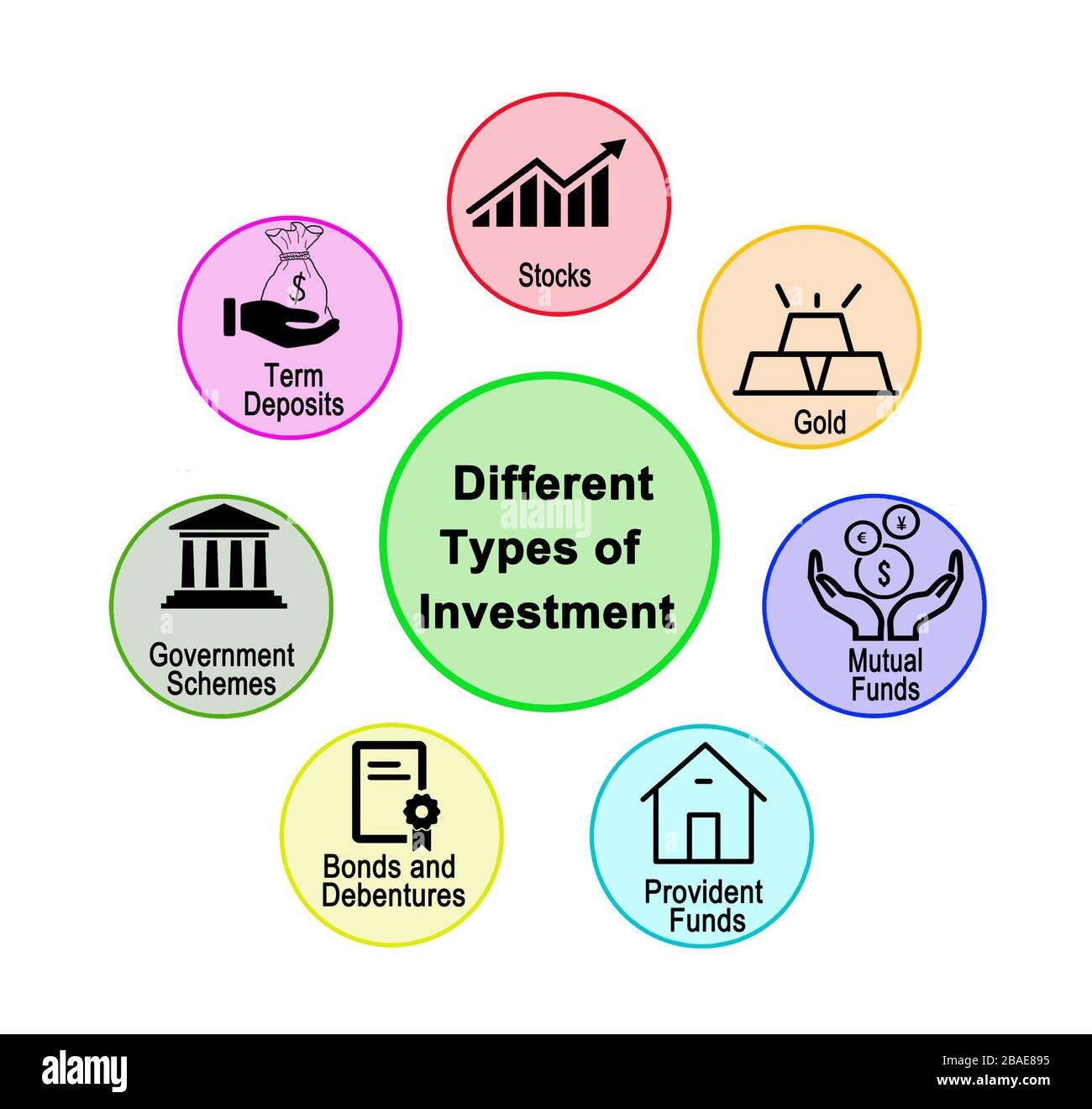

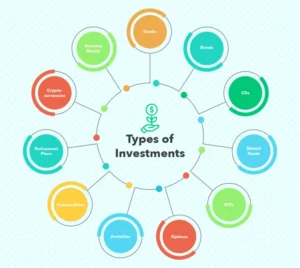

Investing is a crucial aspect of building long-term wealth, and understanding the different investment types is key to making informed financial decisions. Each investment avenue comes with its own set of risks and rewards, making it essential for investors to diversify their portfolios. Let’s delve into various investment types, exploring their characteristics and potential benefits.

Stock Market Investments

To begin with, investing in stocks is one of the most common and dynamic ways to grow wealth. When you purchase a share of a company’s stock, you become a partial owner, and your returns depend on the company’s performance. The stock market’s volatility offers both risks and opportunities. Long-term investors often benefit from the market’s overall upward trend, while short-term traders navigate daily fluctuations.

Fixed-Income Securities

Moreover, bonds are debt securities issued by governments, municipalities, or corporations to raise capital. Investors who buy bonds essentially lend money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are known for providing a steady income stream and are generally considered less volatile than stocks. They are a crucial component for risk-averse investors looking for stability in their portfolios.

Real Estate Investments

In addition, real estate investments involve purchasing property with the expectation of appreciation over time. This can include residential or commercial properties, as well as real estate investment trusts (REITs). Real estate offers the potential for both rental income and capital appreciation. While it requires significant upfront capital, the long-term benefits, including tax advantages and portfolio diversification, make real estate an attractive investment option.

Cryptocurrency

Furthermore, cryptocurrencies like Bitcoin and Ethereum have gained significant attention in recent years. Operating on blockchain technology, these digital assets provide decentralization and security. Cryptocurrency investments are known for their high volatility, presenting both substantial risks and rewards. Investors attracted to the potential for significant returns should carefully research and understand the unique characteristics of the crypto market.

Mutual Funds

To add on, mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professionals, offering investors instant diversification without the need for hands-on management. Mutual funds are an excellent option for those seeking a balanced approach to investing, as they spread risk across various assets.

Gold and Precious Metals

Additionally, investing in precious metals, particularly gold, has been a traditional hedge against inflation and economic uncertainty. Gold’s value often moves inversely to the stock market, making it a valuable diversification tool. Precious metals can provide stability to a portfolio during times of market turbulence, acting as a store of value when other assets may be underperforming.

Peer-to-Peer Lending

Peer-to-peer lending platforms enable individuals to lend money directly to other individuals without the need for traditional financial intermediaries. Therefore, this form of alternative investing allows investors to earn interest on their loans. Hence, potentially providing higher returns compared to traditional fixed-income securities. However, it comes with the risk of borrower default, requiring thorough research and risk assessment.

Conclusion

Diversifying your investments across various asset classes is a fundamental strategy for managing risk and optimizing returns. While each investment type has its own set of risks and rewards, a well-balanced portfolio can help mitigate potential losses. Understanding the nuances of stocks, bonds, real estate, cryptocurrencies, mutual funds, gold, and peer-to-peer lending allows investors to make informed decisions aligned with their financial goals. As you embark on your investment journey, consider seeking advice from financial professionals to tailor your portfolio to your unique risk tolerance and objectives.